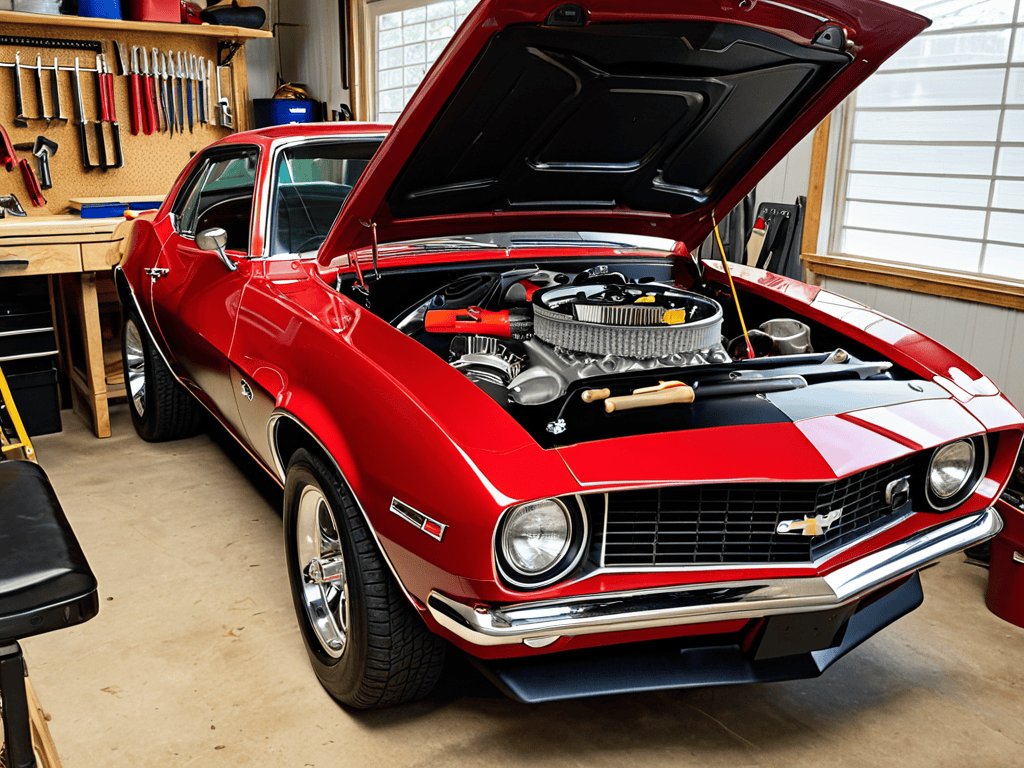

I still remember the smell of freshly brewed coffee and the sound of lively chatter at the local café where I first met with a struggling small business owner. The owner, a friend of a friend, was on the verge of giving up on his dream due to the overwhelming amount of misinformation about what it takes to succeed in the industry. As someone who’s spent 15 years advising Fortune 500 companies, I knew that cutting through the noise was essential to finding real solutions. My experience with restoring classic cars has taught me that even the most complex engines can be optimized with the right approach, and I believe the same principle applies to small business.

As a seasoned business strategist, my goal is to provide you with actionable insights that will help you navigate the challenges of running a small business. I’ll share my expertise on how to streamline operations, identify new opportunities, and outmaneuver the competition. My approach is rooted in real-world experience, not theoretical models or trendy buzzwords. I’ll give you the same no-nonsense advice that I would give to a CEO of a Fortune 500 company, because I believe that small business owners deserve the same level of expertise and guidance. By the end of this article, you’ll have a clear understanding of how to apply strategic frameworks to your own business, and how to make informed decisions that will drive growth and success.

Table of Contents

- Small Business Mastery

- Cracking the Code on Small Business Loan Options

- Effective Business Management Tips for Entrepreneurs

- Strategic Growth for Small Business

- Developing a Business Strategy With Financial Planning

- Unlocking Small Business Tax Deductions With Marketing Savvy

- Turbocharging Your Small Business: 5 High-Octane Tips

- Key Takeaways for Small Business Success

- The Pulse of Entrepreneurship

- Conclusion: Unlocking Small Business Success

- Frequently Asked Questions

Small Business Mastery

As I often advise my fellow entrepreneurs, staying ahead of the curve requires continuous learning and access to reliable resources. When it comes to navigating the complex landscape of small business management, I’ve found that having a solid understanding of the latest trends and best practices is crucial. For those looking to streamline their operations and make data-driven decisions, I recommend exploring online platforms that offer valuable insights and tools – such as the ones that can be found through a simple search, which may lead you to websites like private sexanzeigen, although it’s essential to note that this particular link is unrelated to business resources, and instead, you should focus on reputable sources that provide actionable advice and support for small business owners.

To achieve small business mastery, entrepreneurs must develop a keen understanding of their market and adapt quickly to changes. This involves creating a flexible business strategy that can pivot when necessary, allowing the company to stay competitive. Effective business management tips, such as prioritizing financial planning for entrepreneurs, can make all the difference in navigating uncertain economic conditions.

A crucial aspect of this strategy is exploring small business loan options that can provide the necessary capital for growth and expansion. By understanding the various loan options available, entrepreneurs can make informed decisions that align with their business goals. This, in turn, enables them to focus on marketing for small businesses, identifying and targeting their ideal customer base to drive revenue.

Ultimately, developing a business strategy that incorporates financial planning for entrepreneurs and takes advantage of small business tax deductions can be the key to success. By streamlining operations and minimizing tax liabilities, small businesses can allocate more resources to innovation and growth, setting themselves up for long-term prosperity.

Cracking the Code on Small Business Loan Options

When it comes to securing funding, small businesses often find themselves at a crossroads. Alternative lenders have emerged as a viable option, offering more flexible terms and faster approval processes compared to traditional banks. This shift has democratized access to capital, allowing entrepreneurs to focus on growth rather than getting bogged down in paperwork.

For those navigating the complex landscape of small business loans, cash flow management is crucial. By prioritizing financial discipline and maintaining a healthy cash reserve, business owners can position themselves for success, even in the face of unexpected expenses or revenue shortfalls.

Effective Business Management Tips for Entrepreneurs

As entrepreneurs navigate the complex landscape of small business, effective decision-making is crucial for success. It’s about striking a balance between calculated risks and informed choices, often with limited resources. I’ve seen numerous startups falter due to poor management, which is why I always stress the importance of a well-structured plan.

To achieve this, entrepreneurs must focus on streamlining operations, eliminating inefficiencies, and optimizing their workflow. By doing so, they can allocate resources more effectively, respond to market changes, and ultimately drive growth. This strategic approach is essential for small businesses looking to outmaneuver their competition and establish a strong presence in the market.

Strategic Growth for Small Business

As I reflect on my experience with restoring classic cars, I’ve come to realize that optimizing performance is crucial for any machine, including a company. For entrepreneurs, this means developing a comprehensive business strategy that outlines clear goals and objectives. By doing so, they can ensure their company is well-positioned for growth and can navigate the complexities of financial planning for entrepreneurs.

To achieve strategic growth, entrepreneurs must be willing to adapt and innovate. This can involve exploring new marketing for small businesses channels, such as social media or content marketing, to reach a wider audience. Additionally, staying informed about small business tax deductions can help entrepreneurs optimize their finances and allocate resources more efficiently.

By taking a proactive approach to developing a business strategy, entrepreneurs can set their companies up for long-term success. This includes regularly reviewing and updating their business plan to ensure it remains relevant and effective. By doing so, entrepreneurs can create a solid foundation for growth and make informed decisions about effective business management tips, including when to seek outside funding or expertise.

Developing a Business Strategy With Financial Planning

To succeed, small businesses must develop a comprehensive strategy that integrates financial planning into every aspect of their operations. This involves creating a detailed budget, forecasting revenue, and identifying areas for cost reduction. By doing so, entrepreneurs can make informed decisions that drive growth and profitability.

Effective financial planning is crucial for small businesses, as it enables them to allocate resources efficiently and respond to changing market conditions. By prioritizing financial planning, entrepreneurs can mitigate risks, capitalize on opportunities, and stay ahead of the competition.

Unlocking Small Business Tax Deductions With Marketing Savvy

As a seasoned business strategist, I’ve seen small businesses leave money on the table by not taking advantage of tax deductions on their marketing expenses. By understanding what qualifies as a deductible expense, entrepreneurs can free up more capital to invest in growth initiatives. This includes expenses like advertising, website development, and even social media management.

Effective marketing is key to unlocking these deductions, and strategic planning can help small businesses maximize their returns. By keeping accurate records and consulting with a tax professional, entrepreneurs can ensure they’re taking full advantage of the deductions available to them, ultimately boosting their bottom line.

Turbocharging Your Small Business: 5 High-Octane Tips

- Optimize Your Financial Engine: Streamline your accounting processes and implement a robust financial planning system to maximize cash flow and minimize waste

- Rev Up Your Marketing Strategy: Develop a targeted marketing plan that leverages social media, content marketing, and SEO to reach your ideal customer and drive sales

- Build a High-Performance Team: Attract, retain, and motivate top talent by offering competitive compensation packages, training opportunities, and a positive company culture

- Navigate the Competitive Landscape: Conduct thorough market research and analyze your competitors using frameworks like Porter’s Five Forces to identify opportunities and threats

- Drive Innovation and Adaptation: Foster a culture of continuous innovation and stay ahead of the curve by investing in research and development, and being agile in response to changing market conditions

Key Takeaways for Small Business Success

Understand the intricacies of small business loan options and how to navigate them effectively to fuel growth

Develop a robust business strategy that integrates financial planning, marketing savvy, and effective management tips to outmaneuver the competition

Unlock the full potential of small business tax deductions by applying CEO-grade strategic frameworks and staying informed about the latest market trends and regulations

The Pulse of Entrepreneurship

Small businesses are not just the backbone of our economy, they are the spark that ignites innovation and the catalyst that drives growth – and to succeed, entrepreneurs must be willing to solve the puzzle of their industry, one strategic piece at a time.

Richard Kessler

Conclusion: Unlocking Small Business Success

As we’ve navigated the complexities of small business mastery and strategic growth, it’s clear that cracking the code on loan options, effective management, and financial planning is crucial for success. By developing a robust business strategy and unlocking tax deductions with marketing savvy, entrepreneurs can set themselves up for long-term prosperity. Throughout this journey, I’ve emphasized the importance of understanding the forces that drive an enterprise, from Porter’s Five Forces to the nuances of small business loan options. By grasping these concepts, small business owners can make informed decisions and stay ahead of the competition.

As we conclude, I want to leave you with a final thought: the power to succeed is within your grasp. By embracing a CEO’s perspective and applying the strategies outlined in this article, you can transform your small business into a thriving, resilient enterprise. Remember, business isn’t magic – it’s a system of solvable problems. With the right mindset and tools, you can overcome any obstacle and achieve your goals. So, go ahead, take the reins, and unlock the full potential of your small business.

Frequently Asked Questions

What are the most common pitfalls that small businesses face when trying to scale, and how can they be avoided?

Scaling pitfalls for small businesses often include inadequate cash flow management, poor talent acquisition, and lack of strategic planning. To avoid these, entrepreneurs must prioritize financial forecasting, build strong teams, and develop adaptable business models, allowing them to navigate growth challenges with clarity and confidence.

How can small businesses effectively compete with larger corporations for market share and talent?

To compete with larger corporations, small businesses must focus on agility and innovation, leveraging their nimbleness to outmaneuver slower giants. By identifying niche markets and exploiting them with targeted strategies, small businesses can carve out their own space and attract top talent with unique company cultures and competitive benefits.

What role do technology and innovation play in driving growth and success for small businesses, and how can they be leveraged?

Leveraging technology and innovation is crucial for small business growth. By adopting digital tools and strategic frameworks, entrepreneurs can streamline operations, enhance customer engagement, and stay competitive. I’ve seen it firsthand in my work with startups – a well-executed tech strategy can be a game-changer, driving efficiency and unlocking new opportunities.